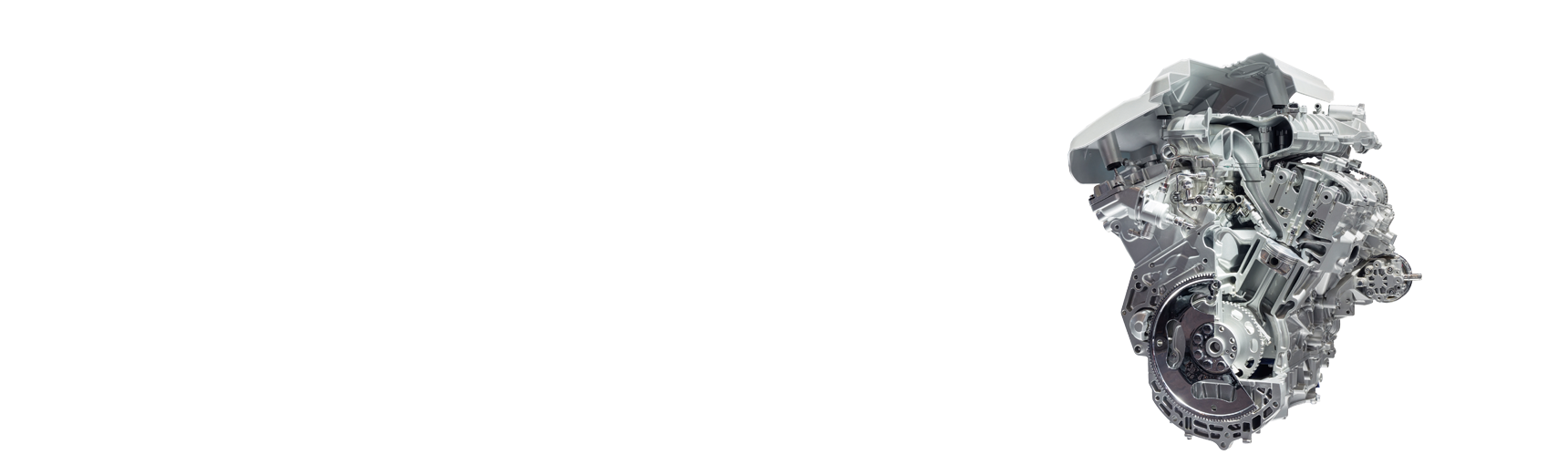

What does machine failure insurance provide?

Insurance that provides protection to the owner or user of a machinery fleet in the event of a breakdown or damage

|

Machine failure insurance

|

|

Mechanical failures

|

standard scope

|

|---|

|

Electrical damage

|

standard scope

|

|---|

|

Intrusion of foreign matter into machinery

|

standard scope

|

|---|

|

Machine operator error

|

standard scope

|

|---|

|

Malfunction of control devices or protection devices

|

standard scope

|

|---|

|

Design, construction and production errors

|

standard scope

|

|---|

|

Protection during inspections, maintenance and repairs

|

standard scope

|

|---|

|

Transportation of machinery

|

optional

|

|---|

|

Assembly of machines

|

optional

|

|---|

|

Loss of profits

|

optional

|

|---|