What does life insurance with UFK offer?

Life insurance

-

Payment in the event of serious illness

-

Cancer support

-

Foreign second medical opinion

-

Payment in the event of incapacity for work

-

Treatment abroad

-

Payment for treatment and hospitalization

-

Hospitalisation benefit

-

Private medical care

-

Assistance after an accident

-

Protection for your loved ones

-

Takeover of contribution payments

What is it about?

A supplementary serious illness agreement will ensure that you receive a payout so that, in the event of a serious illness, you can more easily pay for, for example, medical treatment and qualified medical assistance, buy essential medicines or use private clinics.

What are the benefits?

What is it about?

The Cancer Assistance supplementary contract will provide you with support and specialist assistance if you develop cancer. This will make it easier for you to seek specialist assistance and undergo necessary tests.

What are the benefits?

What is it about?

With this supplementary contract, you can count on the opinion of world-class specialists if you fall ill. Without having to travel abroad, you will make sure that the diagnosis received is correct and the treatment planned is the best possible.

What are the benefits?

What is it about?

The Incapacity to Work supplementary contract will ensure that you receive a payout if you are unable to earn a living on your own after an illness or accident. With these funds, it will be easier for you to maintain your standard of living, pay for treatment or rehabilitation.

What are the benefits?

What is it about?

Getting cancer or having to undergo a complicated surgery can be the most difficult experience in your life. In such situations, it helps to be able to count on the prompt assistance of the best professionals.

The Treatment Abroad supplementary agreement will ensure that you have access to medical care at a clinic abroad - our partner, Further Underwriting International SLU, will organise your trip, pay for your treatment and support you every step of the way.

What are the benefits?

What is it about?

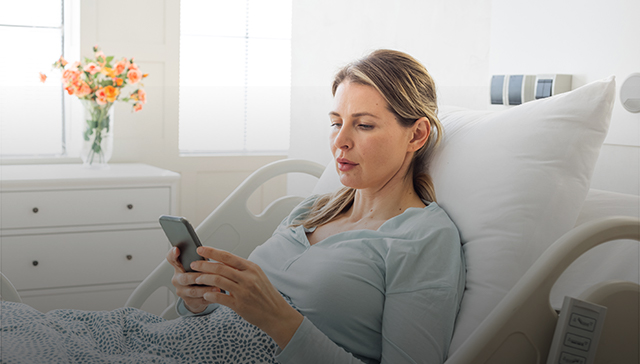

The For Health supplementary contract will ensure that you receive a payout if you are treated in hospital or at a same-day surgery facility. This money can help pay for further treatment, long-term therapy or rehabilitation.

What are the benefits?

What is it about?

The Hospitalisation supplementary agreement will ensure that you are paid if you are hospitalised due to an illness or accident.

What are the benefits?

What is it about?

The Be Healthy (Bądż Zdrów") medical package is a supplementary contract that will give you access to private medical care throughout Poland.

What are the benefits?

What is it about?

You can enter into supplementary contracts to ensure that you and your loved ones receive a payout in the event of various consequences of an unfortunate accident. You can use it, for example, to pay for medical care, nursing care, rehabilitation, and to adapt your home to meet the needs of a disabled person.

What are the benefits?

What is it about?

With a term life insurance contract, you can ensure additional protection for your loved ones. The contract allows you to insure the life and health of your loved ones, e.g. your partner or children.

What are the benefits?

What is it about?

With the Contribution Insurance supplementary contract, we will take over payment of the premiums for your policy if you are unable to work for at least six months due to health problems.

What are the benefits?

How to make a claim

Do you want to file a claim?

Documents

Frequently asked questions about life insurance

It is a protection and investment insurance policy that provides financial support for your loved ones if you’re no longer there, and allows you to put money aside for any purpose, such as retirement, building up capital for your child or simply ‘for a rainy day’. You can also get help if you have a health problem with supplementary contracts to your life insurance with UFK.

You pay the insurance premium - starting from as little as PLN 150 per month - on a regular basis. Part of this premium is used towards the cost of the insurance cover and part is used for investment and we convert it into units of the insurance funds specified in the contract. Funds vary in the level of risk and the possible returns. Their availability depends on your investment profile.

The fund units are credited to your policy account. The value of the account is equal to the value of all the units in it. You can withdraw some of the funds you have accumulated free of charge after three years of the contractual term if all premiums for that period have been paid. You can also deposit additional amounts into the account - from as little as PLN 500.

You can find important information about insurance in the “Basic Information” document.

- You meet with an agent (also online) to discuss your needs

An insurance agent will explain to you how insurance works and make sure it is suited to your needs. Once they know your expectations, they will help you choose the right sum insured. They will also determine your investment profile, so you will know which unit-linked funds are available to you. It will also offer you supplementary contracts to ensure that you are supported in the event of health problems. - You answer questions about your health and lifestyle

Insurance is about life and health, so the agent will ask you about your health, such as chronic illnesses and serious health problems in the past. In special cases, we will ask you for more information (e.g. medical records) and ask you to get additional examinations. You will undergo them out at our expense and in our designated facilities. - You receive a policy that confirms the contract

The agent will then ask you to accept the application and pay the first premium. We issue a policy document based on the information you have given us. In certain situations, we may offer you a contract on different terms (e.g. for a higher premium) or refuse to enter into a contract.

You can manage your life and health insurance online - just log into the My Allianz Customer Service.

At any time you can, among other things:

- request an extension of the coverage, which is possible by concluding additional contracts for yourself, your partner and your children and by changing the sum insured,

- increase the premium allocated to investments and, after 3 years of the contract and if all premiums have been paid, request a reduction,

- change unit-linked funds - you can do this easily and conveniently via My Allianz Customer Service.

You can also update your personal and contact details, e.g. in My Allianz

In the event of the death of the Insured, we will pay the beneficiaries designated by the Insured:

- the current life insurance sum,

- the value of the funds held in the account.

If the death is the result of an accident, we will also pay out an additional amount - up to PLN 400,000. The Insured enjoys this additional protection until the next policy anniversary date that falls after the Insured’s 70th birthday.

You can change the funds under the “Accumulated funds” tab - click on “Change funds”. The rules for changing funds are described in detail in the Unit-Linked Funds Terms and Conditions.

Your Plan is life and health insurance combined with cash accumulation (insurance with UFK). A predetermined part of the premium for the policy is always earmarked for investment. This not only enables you to ensure financial support for yourself and your loved ones in various situations, but also to put money aside for the future.

Your Life is life and health insurance where, by choosing an optional supplementary life insurance contract with insurance equity funds, you can also accumulate money.